- Why Richie?

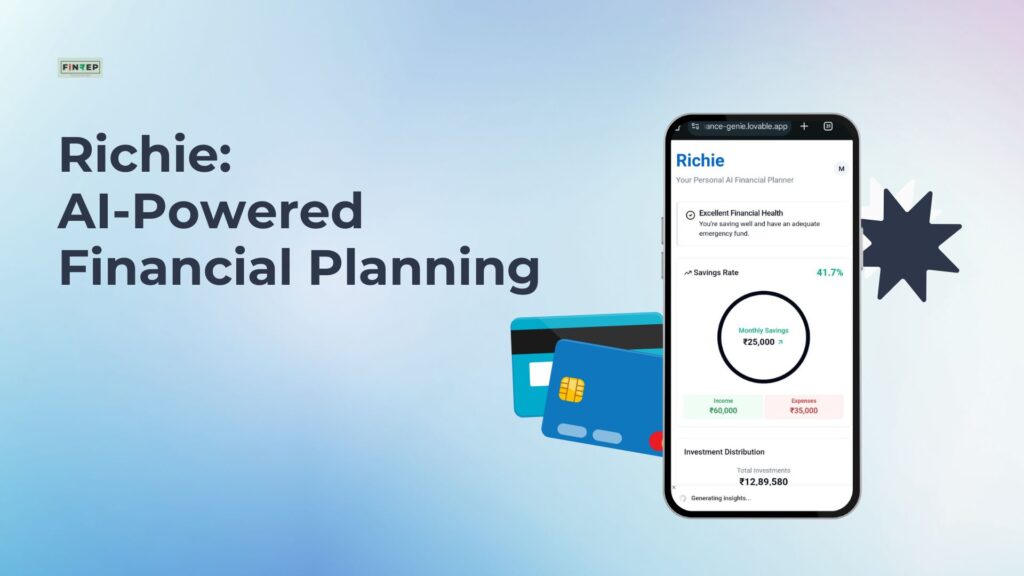

- What Makes Richie Different?

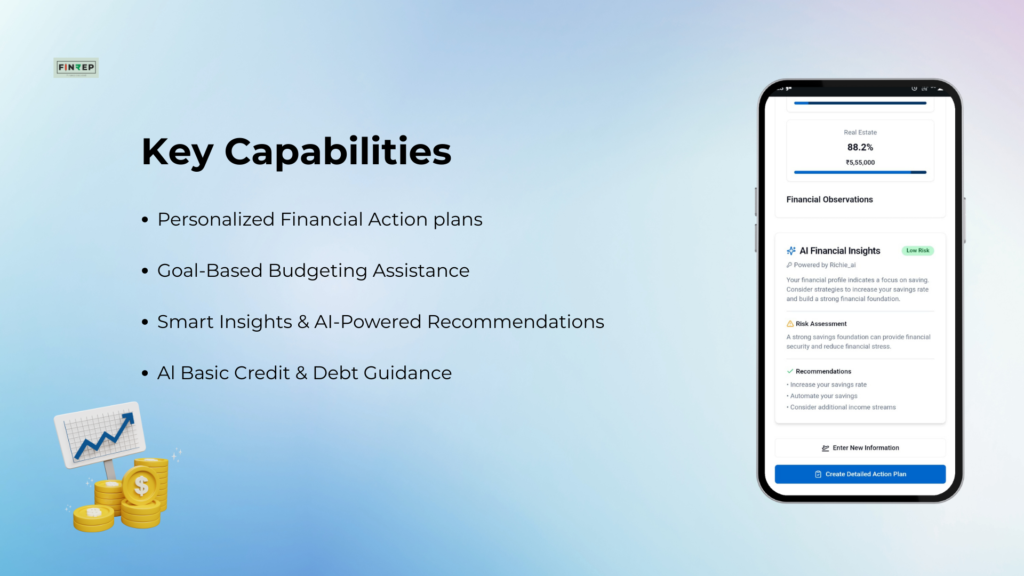

- Features That Make Richie the Finance Buddy You Deserve

- Richie’s Mission: Making Personal Finance Feel Personal Again

- Who Is Richie For?

- The Top Mistakes Richie Helps You Avoid

- Richie’s Approach to Financial Literacy

- Success Stories: How Richie Changed Lives

- Conclusion: Come Richie With Us

- Join the Waitlist

We were young, ambitious, and just starting our careers. We were making money, yes — but also making mistakes. We weren’t taught how to handle finances in school, and let’s be honest, most of us were too intimidated to ask our parents or YouTube “experts.”

One of us got charged a late fee on a credit card and didn’t even know how it happened. Another put money in a random mutual fund because a friend recommended it — and then panicked during a market dip.

We watched our friends:

- Buy new phones on EMI with no emergency savings

- Sign up for five credit cards just for cashback offers

- Skip health insurance thinking “abhi toh young hoon”

Sound familiar?

We realised we all had one thing in common: we wanted to do better with our money, but didn’t know how — and didn’t know who to ask.

That’s when Richie was born.

Why Richie?

We didn’t want to build just another finance app. We wanted to build a buddy — one that actually gets what it’s like to…

- Be in your 20s or 30s trying to juggle expenses, dreams, and societal pressure

- Feel overwhelmed by acronyms and advice that doesn’t apply to your life

- Want to save, invest, and plan — but not be bored or shamed in the process

Richie is here to meet you where you are — not where someone else thinks you should be.

What Makes Richie Different?

No Judgement

Whether you’ve maxed out your credit cards or never created a budget in your life, Richie welcomes you. No finger-pointing. No guilt trips. Just honest support.

No Jargon

You don’t need to know what ELSS, PPF, or NAV stands for. Richie breaks it down for you like a friend would — using relatable language and real-life analogies.

No Fear

Your salary doesn’t define your financial confidence. Whether you earn ₹20K or ₹2L/month, Richie ensures you feel in control and supported every step of the way.

No Boredom

Personal finance has a reputation for being dull. Not with Richie. We’ve turned it into a gamified, interactive, and personalized journey.

Features That Make Richie the Finance Buddy You Deserve

Guilt-Free Money Tracking

Richie doesn’t just track your expenses — it understands them. You won’t be scolded for ordering food thrice a week. Instead, Richie helps you see patterns and make better choices.

Gamified Financial Planning

Set goals like “₹50K for a Goa trip” or “Pay off my student loan in 18 months” — and watch Richie turn it into a game. Progress bars, milestones, and rewards make it fun and motivating.

Personalized Education

Instead of throwing all financial knowledge at you at once, Richie delivers it bit by bit, in the exact moment you need it — whether it’s payday or investment day.

Lifestyle-Based Recommendations

Don’t want to skip your weekend plans? Richie won’t make you. Instead, it’ll suggest smart tweaks that align with your lifestyle while helping you save and grow your money.

Richie’s Mission: Making Personal Finance Feel Personal Again

Richie isn’t built to sell you credit cards or mutual funds. It’s built to help you feel financially confident, no matter your income or background.

We’re here to:

- Help you make better financial decisions

- Build long-term habits without burnout

- Redefine how young Indians approach money

Who Is Richie For?

- Recent graduates struggling with their first salary

- Young couples planning life together

- Freelancers and side-hustlers with irregular income

- Anyone who wants to feel less “broke” by the 20th of every month

If you’ve ever felt lost, anxious, or ashamed about money — Richie is for you.

The Top Mistakes Richie Helps You Avoid

Falling for EMI Traps

Buying a phone or laptop on EMI is easy — but do you really need it? Richie helps you weigh cost vs. value vs. urgency.

Ignoring Emergency Funds

Life is unpredictable. Richie helps you build a buffer without feeling deprived.

Delaying Insurance

“Young hoon” is not a financial plan. Richie explains insurance without scare tactics, helping you get covered smartly and affordably.

Blind Investing

Investing because a friend told you to? Richie teaches you the why and how before the what.

Richie’s Approach to Financial Literacy

Simplifying Complex Topics

No one becomes an expert overnight. Richie breaks down everything — from mutual funds to taxes — into bite-sized, engaging lessons.

Building Confidence, Not Fear

Traditional finance apps use guilt. Richie uses empathy. The goal? You feeling proud, not punished.

Success Stories: How Richie Changed Lives

“I used to feel broke just 10 days after salary day. Richie helped me plan without cutting out all fun.” — Tanvi, 26, Mumbai

“I finally understood how mutual funds work — without watching 15 YouTube videos.” — Rahul, 30, Pune

“For the first time, I feel like I’m not just earning, I’m growing.” — Ayesha, 24, Hyderabad

Conclusion: Come Richie With Us

This isn’t just a blog post — it’s the start of a movement.

A movement to make money feel less scary.

A movement to treat financial literacy as self-care.

A movement to put the “personal” back in personal finance.

Come build with us. Come grow with us. Come Richie with us.

Join the Waitlist

🎯 Join the waitlist now and be the first to experience the future of personal finance with Richie — your new money buddy.

Don’t just save money. Start owning it.

👉 Join the Waitlist — and get early access to exclusive features, community tools, and rewards.

📎 Relevant Resource:

SEBI’s Investor Education Page — A great place to understand regulatory basics.